Top Guidelines Of Commercial Insurance In Toccoa Ga

Some Known Details About Insurance In Toccoa Ga

Table of ContentsNot known Facts About Life Insurance In Toccoa GaSome Known Facts About Annuities In Toccoa Ga.Little Known Questions About Home Owners Insurance In Toccoa Ga.9 Easy Facts About Final Expense In Toccoa Ga ShownAn Unbiased View of Automobile Insurance In Toccoa Ga3 Simple Techniques For Commercial Insurance In Toccoa Ga

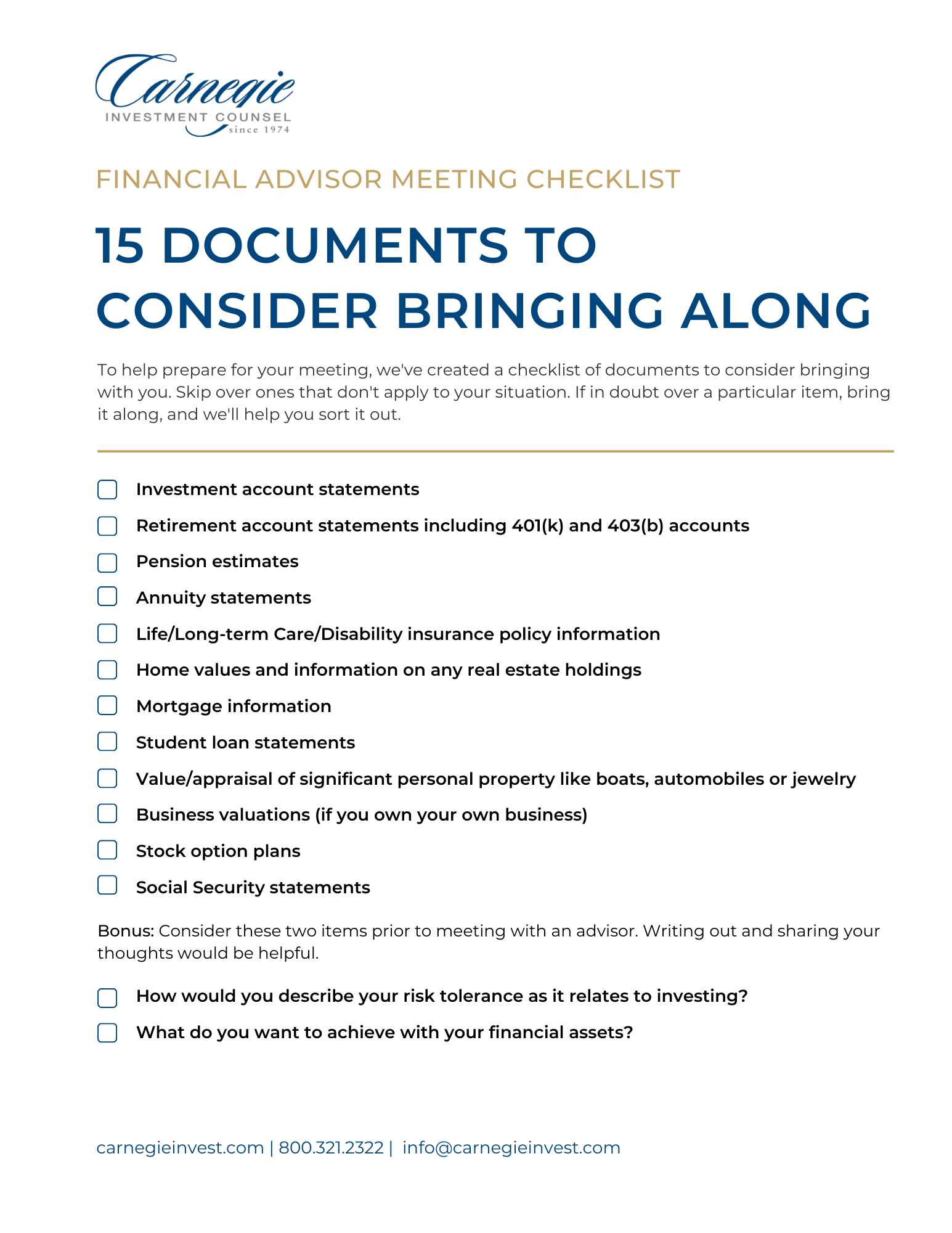

This can indicate organizing a single session with a therapist to maximize your funds or it could suggest having a certified financial investment adviser on retainer to manage your possessions. Repayment structures differ relying on client requirements and the services offered by the financial expert. A financial advisor might work for a firm and as a result gain an income, or they might make a hourly rate separately.Right here are five actions to help you choose an economic expert for you. Discover and work with fiduciaries, monetary experts, and economic coordinators that will certainly work with you to accomplish your wide range goals.

Our viewpoints are our own. https://www.slideshare.net/jimthomas30577. Here is a and right here's just how we earn money. Prior to you begin trying to find the right consultant, reflect on what you're wanting to get out of that connection. Financial consultants provide a vast array of services, so it's an excellent concept to know what you require aid with before you start your search.

The Buzz on Life Insurance In Toccoa Ga

Identify why you're looking for financial aid by asking the complying with questions: Do you need aid with a budget? Would certainly you such as to develop an economic plan? Your answers to these concerns will certainly aid you find the ideal kind of monetary consultant for you.

, or CFP, classification have a fiduciary responsibility to their clients as component of their qualification (https://www.livebinders.com/b/3523954?tabid=6f95ddb3-5f0a-0777-6394-be36dfb58017).

Nerd out on spending information, Subscribe to our regular monthly investing e-newsletter for our nerdy take on the stock market. Financial consultants have a track record for being pricey, yet there is an option for every budget.

An Unbiased View of Commercial Insurance In Toccoa Ga

How a lot you need to invest on a monetary consultant depends on your spending plan, properties and the level of monetary advice you require. If you have a tiny profile, an in-person advisor may be excessive you will save money and obtain the guidance you require from a robo-advisor. If you have a difficult financial scenario, a robo-advisor may not give what you need.

25% of your account equilibrium per year, standard in-person advisors generally set you back around 1% and online financial preparation solutions tend to drop somewhere in between. Who can be a monetary expert?

Why is "advisor" occasionally meant "consultant"? Some organizations like the Foundation for Financial Planning provide cost-free aid to people in demand, including experts and cancer cells patients. And while you should not believe every little thing you read on the internet, there are heaps of respectable resources for economic information online, including federal government sources like Capitalist.

If you are attempting to choose a financial advisor, recognize that anyone can lawfully make use of that term. Always request for (and verify) a consultant's particular credentials. Anybody who offers which most website here financial experts do must be signed up as a financial investment expert with the SEC or the state if they have a particular amount of possessions under administration.

Lead ETF Shares are not redeemable straight with the releasing fund besides in large aggregations worth numerous bucks. ETFs are subject to market volatility. When buying or marketing an ETF, you will certainly pay or obtain the existing market rate, which might be extra or much less than internet possession worth.

Our Insurance In Toccoa Ga Statements

The majority of financial experts function normal full-time hours during the work week. Numerous consultants are used by companies, yet about 19% of economic experts are independent, according to information from the Bureau of Labor Data. In terms of qualifications, economic consultants generally have at least a bachelor's level in a related topic like service, money or mathematics.

There are some crucial differences in between a financial advisor and an accounting professional that you should recognize. Accountants are more concentrated on tax obligation planning and prep work, while monetary experts take an alternative check out a client's monetary circumstance and aid them prepare for lasting financial goals such as retired life - Annuities in Toccoa, GA. In other words, accounting professionals deal with the previous and existing of a customer's funds, and financial advisors are concentrated on the customer's financial future

Getting My Medicare Medicaid In Toccoa Ga To Work

Accounting professionals tend to be worked with on a temporary basis and can be believed of as professionals, whereas economic consultants are more probable to develop a lasting expert partnership with their clients. Accounting professionals and monetary advisors differ in their strategy to financial subjects. Accounting professionals have a tendency to specialize in a particular area, while financial experts are typically generalists when it comes to their economic expertise.